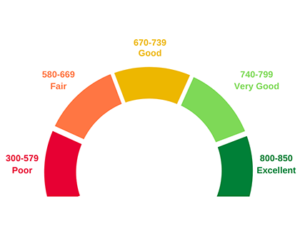

You can get your credit report for free but comprehending financial terms and language is very important and can be misinterpreted easily if you do not understand how to read your credit report. People often get confused with figures and abbreviations and misinterpret the meaning of the document.

You can get your credit report for free but comprehending financial terms and language is very important and can be misinterpreted easily if you do not understand how to read your credit report. People often get confused with figures and abbreviations and misinterpret the meaning of the document.

To start with, we should know there exist three credit reporting firms in the US, Experian, TransUnion and Equifax. Most people believe going through a single credit report should serve the purpose of the other two. This is incorrect, as people should realize each of these credit-reporting firms issue reports that do not carry the same exact information but when put together could furnish you with a lot of useful information.

Another mistake people repeatedly make is to get a credit report from a friend who is in the banking industry. These credit reports are meant for those who are a part of the credit industry and will surely confuse the common man with terminologies and huge figures. The best source to extract a user-friendly credit report is to subscribe for the report directly from the credit bureau.

Understanding A Credit Report In And Out

There are four main segments in a credit report

1. Identifying information

2. Credit history

3. Public records and

4. Inquiries

Identifying information is the section where you get information to identify yourself. Examine this segment thoroughly and see if all the information about you is true. Make sure information like name, social security number, address (old and new), date of birth, telephone numbers, driver's license number, your current employer and your spouse's name are correct.

Next is the credit history. If you are wondering what the trade lines are, these are nothing but terms used for each of your accounts. Details of every account are mentioned here - the creditor's name, a jumbled account number, the start date of your account, type of credit taken (rotating or installments), joint holder's name (if any), loan amount, maximum credit allowed, maximum credit taken, balance amount due, monthly defrayments, account status (open, inactive, closed, paid, etc.) and your account maintenance.

The Experian's report provides a clear statement of your payment history - payment on time, generally pays late by 30 days, etc. The other reports add details on internal collection and charged off or default. The term 'charge off' means the creditor has tried his best to get beck his money but has finally quit. Payment codes range from 1 to 9 and the good payment history is indicated by R1 or I1.

The public record section is generally blank. If you have a public record filled that means you were involved illegal doings. It does not talk about your criminal record but is more of a finance record that lists out information like bankruptcies, judgments and tax liens. So a bad public record means a bad example set for creditors.

The last segment is the inquiries which shows all those who have viewed or requested for your credit report. Soft as well as hard inquiries get immediately stored into your records to help you analyze the report.

Finally, if there is any discrepancy in the information given like a wrong account or misprint of credit amount, you will have to fill the supplementary form that comes along with the report or stick to the explanatory sheet guidelines. You will then have to patiently wait for a month or so for an explanation from the creditor. The creditors believe that more than three quarter of the credit reports have some type of error. So be careful while you read your credit report and inform the authorities for any differences.